In the fast-paced world of stock markets, keeping a keen eye on the share price trends of companies can offer valuable insights for investors, traders, and financial analysts. One such company that has attracted attention in recent times is Subex, a global provider of business and operations support systems (B/OSS) for digital service providers. This article delves into the share price trend of Subex in the market, exploring various factors that could impact its valuation and future prospects.

Understanding Subex: A Brief Overview

Founded in 1992, Subex has established itself as a leading player in the telecommunications software industry, offering solutions that help digital service providers to achieve operational excellence and drive business growth. With a global presence spanning over 90 countries, Subex has built a reputation for its innovative products and services that cater to the evolving needs of the digital economy.

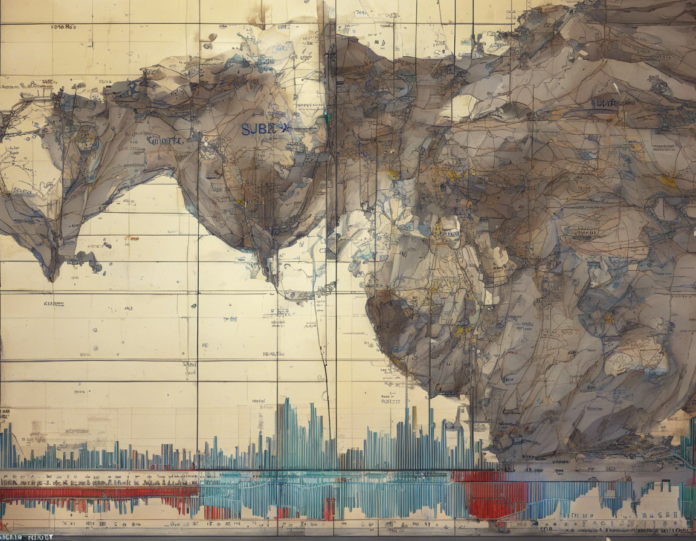

Historical Share Price Performance

To gain a deeper understanding of Subex’s share price trend, it is essential to analyze its historical performance in the stock market. Over the past few years, Subex’s share price has witnessed significant fluctuations, influenced by various internal and external factors. From periods of robust growth to phases of consolidation, the company’s stock has experienced a rollercoaster ride reflecting market sentiments and industry dynamics.

Factors Influencing Subex’s Share Price

Several key factors can impact the share price of Subex, potentially driving it up or down in the market. These factors include:

1. Financial Performance

- Revenue Growth: Investors closely monitor Subex’s revenue generation and profitability metrics to assess its financial health.

- Earnings Per Share (EPS): A company’s EPS can influence investor sentiment and, consequently, its share price.

- Debt Levels: Subex’s debt-to-equity ratio and overall debt position can impact its valuation.

2. Industry Trends

- Competitive Landscape: Changes in the competitive landscape of the telecommunications software industry can affect Subex’s market position and share price.

- Technological Advancements: Innovation and technological developments in the sector can drive investor interest in Subex.

3. Market Sentiments

- Investor Perception: Sentiments, market rumors, and macroeconomic factors can sway investor confidence in Subex.

- Analyst Recommendations: Recommendations from analysts and industry experts can influence the share price.

Recent Developments and Future Outlook

In recent times, Subex has made strategic moves to enhance its product portfolio, expand its global footprint, and forge partnerships to drive growth. These developments can play a crucial role in shaping the company’s share price performance in the foreseeable future. Additionally, macroeconomic trends, regulatory changes, and technological innovations will also be pivotal in determining Subex’s market valuation.

Frequently Asked Questions (FAQs)

-

What has been the recent share price performance of Subex?

Subex’s share price has shown volatility in recent months, with fluctuations reflecting market dynamics. -

How does Subex compare to its competitors in the industry?

Subex competes with other players in the telecommunications software sector, with its unique offerings and global presence setting it apart. -

What are analysts forecasting for Subex’s share price in the upcoming quarters?

Analyst forecasts vary, with some predicting growth potential for Subex based on its market positioning and growth strategies. -

How do global economic conditions impact Subex’s share price?

Global economic conditions, such as currency fluctuations and trade policies, can impact Subex’s share price, along with overall market trends. -

What role does management performance play in influencing Subex’s share price?

Effective management strategies, leadership decisions, and operational performance can influence investor confidence and, subsequently, Subex’s share price.

In conclusion, analyzing the share price trend of Subex requires a comprehensive assessment of financial performance, industry dynamics, market sentiments, and future outlook. By staying informed and conducting thorough research, investors can make informed decisions regarding Subex’s stock, navigating the complex landscape of the stock market with greater clarity and confidence.